|

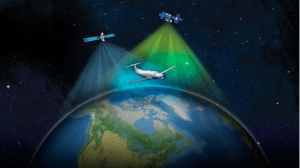

| Aircraft switching from beam to beam or satellite to satellite. Photo: ViaSat |

[Avionics Today 02-17-2015] Changing attitudes about In-Flight Connectivity (IFC) may lead the way to monetizing the market. This is the attitude expressed by Mark Dankberg, chairman and chief executive officer of California-based satellite communications company ViaSat, which currently has contracts with major airlines such as JetBlue and Continental to equip for Internet connectivity via its satellite constellation. In a conference call last week regarding an otherwise underwhelming third quarter with further flat outlooks for the company in the upcoming year, the CEO noted opportunities for new in-flight Wi-Fi strategies and technology to drive revenue, even in the face of a shrinking U.S. market.

“Aviation broadband and consumer broadband are the big growth drivers in ViaSat’s business in both the near and medium term,” Andrew Spinola, senior analyst at Wells Fargo told Avionics Magazine. Last quarter, ViaSat reported strong aviation shipments with 276 total planes in service to date with its contracts with major airlines. But with its two big air transport clients expecting near completion for installations on their contracts by mid-2015, Spinola warns that the company needs to score business elsewhere to keep the momentum going. “The aviation business will slow after JetBlue and Continental are fully activated unless ViaSat wins additional business,” he said, noting that most of the commercial airlines in the United States are already tied up in IFC-equipage contracts.

ViaSat’s CEO doesn’t seem phased by the slow down in the North American market, however, and hopes to grow the company’s portfolio through new revenue-driving strategies that follow what he believes to be a changing attitude surrounding the expectations of IFC price, speed and reliability.

“Everyone pretty much took for granted that in-flight Wi-Fi was kind of slow, independent of the price point. Airlines were focused on just checking the box to say they had Wi-Fi … but here you can see attitudes are definitely changing,” said Dankberg in reference to an image on Routehappy.com illustrating customer satisfaction with ViaSat’s Exede Wi-Fi offering available on JetBlue. “Now, we are seeing increasing attention paid to the quality of the Wi-Fi by the airlines. In-flight Wi-Fi is more and more seen as more than just ancillary revenue. More airlines are asking questions about how the best Wi-Fi could be monetized and integrated into a holistic brand strategy. It’s not yet totally clear what those monetization strategies are but, as in most things, Internet and mobile economic value tends to follow user engagement.”

ViaSat is already working out ways to up user engagement alongside JetBlue, with tactics such as offering the service free-of-charge through a series of strategic partnerships.

Additionally, technology-related strategies are also coming into play. Particularly in terms of addressing latency concerns, which still pop up as an issue when it comes to pitting the satellite-based offering against the more traditional Air-to-Ground (ATG) services. However, Dankberg believes the company can overcome the latency challenges through enhancing speed and bandwidth.

“We believe that the dominant measures of technical performance for broadband, really, are speed and bandwidth,” Dankberg explained. “Yes, latency is important, but for the vast majority of Internet traffic, speed and bandwidth are what’s decisive.” While the company has expressed interest in combining its satellite offering with an ATG system — much like Gogo and Inmarsat have communicated in the past few months — it feels that improving these areas may be even more effective in providing customer satisfaction than solutions such as lower-orbit satellites, which can provide lower latency than geosynchronous ones.

The company’s Ku/Ka band satellite system that will come available with the launch of its ViaSat 2 satellite later this year, as well as a dual-band offering antenna the company is planning to introduce, are also driving enthusiasm for new tech and spectrum. ViaSat tested its IFC system and antenna on a Boeing 757-200 aircraft last July, demonstrating the broadband en route communications as the aircraft transitioned among multiple satellite beams from six satellites and three Ku- and Ka-band networks. The roaming Ku/Ka offering will be available for the government market alongside the commercial sector later this fiscal year. The company is confident about the new offering’s success, even in the face of doubts that investors will turn out to back it.

“The lower levels of net adds have some investors concerned that the market won’t be there to support ViaSat 2, but there are a number of reasons that ViaSat is confident in the case for V2, such as the greater total capacity, substantial increase in coverage, and technology innovations that will allow for meaningfully greater data allowances on V2 service plans, according to the company,” said Spinola, who noted that ViaSat has hinted that the expanding offering may even see new markets, such as the business aviation segment. And ViaSat 2 may well open the door the company needs to keep the IFC business booming despite the lack of U.S. airlines looking for new connectivity.

“Fundamentally, we see bandwidth economics as the enabling technology,” Dankberg said. “Next year ViaSat 2 satellite will be a big step forward compared to ViaSat 1 in both bandwidth economics and geographic coverage. There aren’t any other Ku- or Ka-band satellite systems coming that have bandwidth economics even close to ViaSat 2.”

The original version of this story was published on ViaSatellite.com.