|

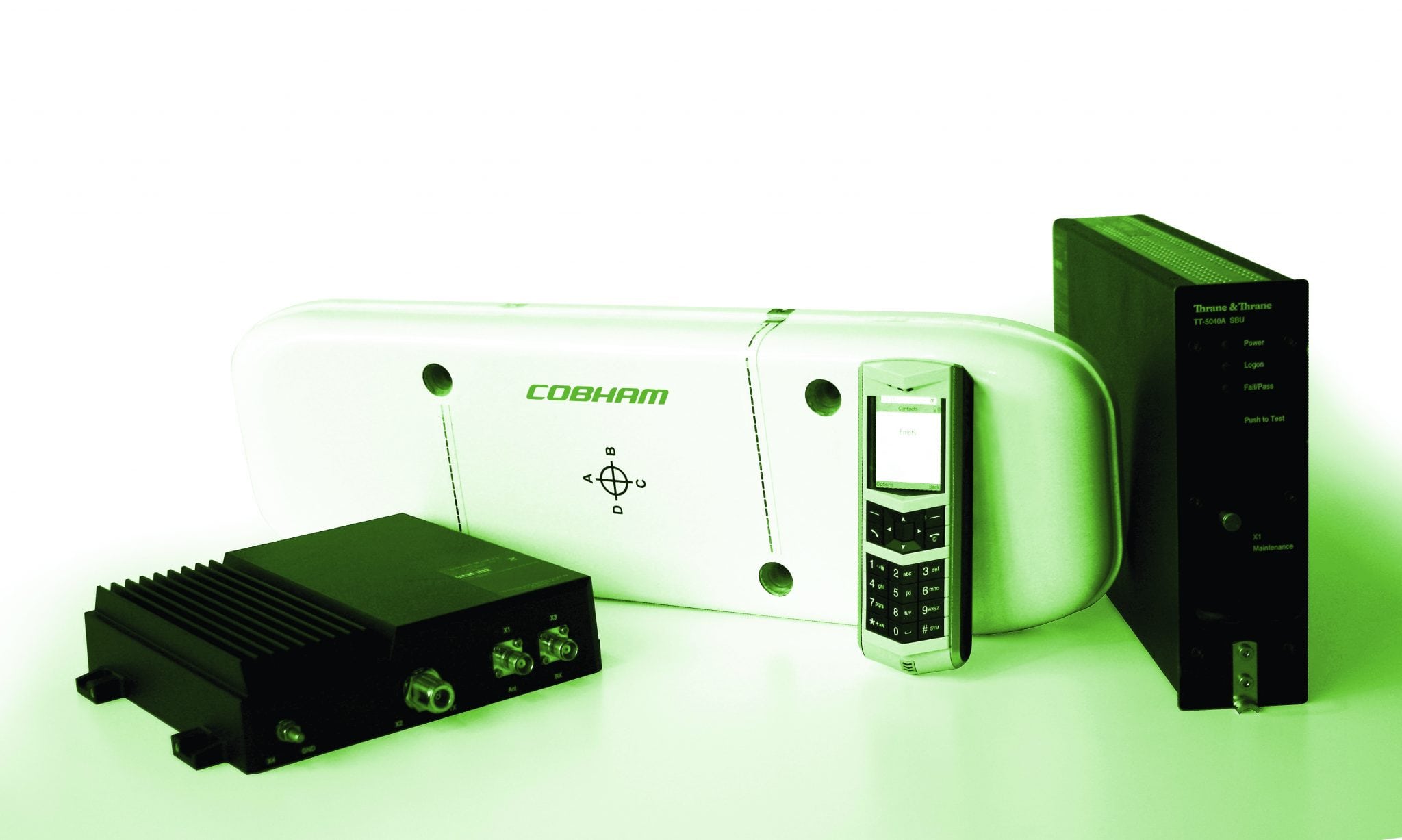

Components of the Cobham AVIATOR 300 system include,

from left to right, High Power Amplifier, Low Noise Amplifier

and Diplexer; intermediate gain antenna; handset; and a

SwiftBroadband Unit. |

Equipped with iPads, smart phones and other portable electronic devices, airline passengers increasingly do not expect to forgo online access while flying, except for maybe the first and last few minutes of a flight. And that might even be a stretch. Passenger expectations combined with the explosion in the use of handheld devices are spurring demand for broadband capability on commercial and business aircraft. That demand is, in turn, stoking competition among and boosting opportunities for service and product providers including antenna vendors who provide essential connections to satellite or ground station signals.

“We do not see any hold back in the general surge” in demand for connectivity, said Walther Thygesen, vice president in charge of Cobham’s Satcom business, based in Lyngby, Denmark. When trying to gauge the potential size of the market, it is important to “keep in mind (that) aircraft remain the last business domain without a widely deployed IP infrastructure.” Cobham’s keenness for the market is underscored by its acquisition of Thrane &Thrane last year, which integrated the two companies’ broad-based portfolio antenna systems under Aviator brand name.

For now, “both the forward fit and retrofit (markets) are healthy,” said Mike Maritan, director, antenna systems at Esterline CMC Electronics. “The retrofit market is much larger for the high bandwidth cabin solutions because of the large in-service fleet.”

And the future looks pretty bright as both the high end and low cost airlines “seem to be quickly moving to the view that the cost of supporting internet connectivity is table stakes, so that there is no segment, except possibly regional jets, that aren’t planning to add the capability,” said Lance Diamond, director of business development at ViaSat.

The air transport and business/general aviation segments “are both moving fairly quickly,” said Jack Jacobs, vice president of the marketing management group at Honeywell. The company is providing its GX Aviation Ka-band satcom avionics and antenna systems for air transport and business and general aviation aircraft that will use Inmarsat’s Global Xpress Ka-band satellite system. In the past several months “we’ve had a big increase (in interest) from the major air transport OEMs and are in full-blown RFP stage now and setting up technical service agreements with them,” said Jacobs. Because they face fewer barriers, the large business and general aviation aircraft manufacturers can “get it done quicker and are looking … (more) for an overall solution” including entertainment and high-speed connectivity. They are also looking at an integrated cockpit and cabin approach “whereas right now the air transport market tends to keep the cabin and cockpit for somewhat separate.”

With all this potential demand and a wide array of available systems, “the provision of IP data to aircraft for both cockpit and cabin (is becoming) more and more feasible,” Thygesen said. It is now up to the aircraft operators, including the airlines, and the satcom industry generally to get “together to form coherent long term plans for data communication and IT infrastructures.”

Ku, Ka and L

The industry remains, at least at this point, divided on how to proceed between those opting to use currently available technology, including L- and Ku-band based satellite systems, and those holding out for the expected power boost from Ka-band-powered systems, slated to be available next year.

“Much has been made of the rivalry between companies offering Ku- and Ka-band options, however, there is more than enough room in the industry for both technologies to coexist,” said Heath Lockett, aerospace analyst at IMS Research. “Every airline has a slightly different requirement for their connectivity solution — the requirements can even be wildly different across a single airline’s fleet.

“Those different approaches will ensure that all technology solutions will continue to exist well into the next decade.”

ViaSat’s Diamond said he expects “there will be a gradual evolution toward Ka-band, driven by the capacity advantages, but Ku and other approaches will remain viable where high-capacity Ka is not yet available; (therefore), our mobile (Ku-band) Yonder service will continue to be an important part of our business for years to come.”

“Some of our customers could not wait (for the Ka-band service), so they have deployed connectivity solutions utilizing L-band and our CMA-2102SB Multi-channel High Gain Antenna system, while others have chosen Ku and others yet are contemplating Ka,” said Maritan. The L-band service has its advantages: it is available globally and uses antennas that are smaller than those used for Ka- and Ku-band, and a single antenna can be used to serve cockpit and cabin requirements, he said. There are also cost and design concerns tied to Ku- and Ka-band antenna systems: “these first generation systems are still very heavy, have significant drag and are expensive.”

“All airborne antenna system designs are challenging due to the stringent requirements imposed by the platform,” said Diamond. The key challenges ViaSat faced in designing the Ku and new Ka version of its V-12 antennas has been obtaining “RF efficiency — getting as much performance as we could out of a small package — and producing a low-weight, highly reliable design,” he said. The company has now manufactured more than 500 Ku-band VR-12 antennas, and the Ka-band version has completed DO-160 testing and is now in production, he said.

The chief concern, however, for a price sensitive industry, is not so much size of the footprint as the profile of the antenna — “the lower the profile, the more aerodynamic airplane is,” said Raju Chandra, vice president of marketing and sales at Tecom Industries, based in Thousand Oaks, Calif. The currently available Ku- and Ka-band solutions have “a small footprint (but) not a small profile, so they have some height.” With current technology, low-profile solutions would drive up costs for the systems “an order of magnitude.” So the operators must balance lower cost equipment cost versus better performance.

|

Type ViaSat’s VR-12 mobile system includes

the antenna, controller (right) and modem. |

Also, with the advance of Ka, industry faces “the need for more RF bandwidth to cover the full range of available Ka-band satellites, (which) … affects aperture design as well as the choice of RF components,” said Diamond. “Medium profile antennas (usually waveguide arrays) with radomes as high as 10 to 12 inches have become accepted for air transport aircraft and necessary for high latitude performance,” he said. “Lower profile antennas will continue to be explored and will be used for certain applications, but lower profile antennas will not replace medium profile antennas,” Diamond said.

“Antenna designs that minimize the effects of high skew angle will also be developed to allow global operation.”

Even with these market and technology challenges, the demand for high data rates “is driving a lot of the innovation and … product development across the market,” said Chandra. In past few years, for example, ViaSat has gotten into the Ka-band market in “a heavy way” with the launch of ViaSat-1; Global Xpress has assembled its competitive team and is poised to launch Ka-band satellites this year. At the same time, Intelsat is launching high-capacity satellites to service the needs of Ku-band systems.

All of this activity is demand driven; companies are not launching satellites because they are “hoping to find customers but because their customers are asking for it,” Chandra said.

Meanwhile, the major broadband providers have been bolstering their operations. Gogo changed its original Air-to-Ground (ATG) technology-based strategy, inking deals with Intelsat to use its Ku-band service and Global Xpress to distribute it Ka-band service when it becomes available, and selected AeroSat’s HR6400 Ku-band antenna system. Gogo also launched ATG-4, an upgrade to its original operation, which delivers up to 9.8Mbps, three times “the peak speed of the previous air-to-ground network,” according to the company. The upgrades add a directional antenna, but “in terms of footprint, the only visible difference between ATG and ATG-4 is we’ve added two side-mounted antennas, and the antennas on the bottom of the plane are slightly larger,” said Anand Chari, Gogo’s senior vice president of engineering and chief technology officer.

“Gogo is technology neutral,” said Chari. “We have the ability to deploy several technologies depending on each individual aircraft and each aircraft mission … (and) don’t believe there is a technological panacea for in-flight connectivity and continue to evaluate and implement based on airline requirements and what makes sense for a given fleet at any given time.” The company will install ATG-4 and Ku-band capability on American Airlines’ new Airbus A320 family and Boeing 737 deliveries “to allow them to offer seamless connectivity wherever they fly, whether that’s in the continental U.S. … or internationally,” said Chari. “Right now, the plan is to continue to use Ku, but we could transition them to Ka at a later date if American chooses to do so.”

|

Tecom’s Kustream 1000 antenna system, which

has hit 1.5 million hours of operational service,

is a part Row 44’s in-flight connectivity product. |

Panasonic Avionics is “going with Ku spot beams (from Hughes) Caprock, MTN (Satellite Communications) and Intelsat,” said Todd Hill, director, technical operations, Global Communications Services at Panasonic Avionics. “While others are going with Ka spot beams, Panasonic still believes that … (its) Ku solution is the best for our customers,” he said. “We offer HTS (High Throughput Satellite) spot beams in high density areas, worldwide coverage and the redundancy of Ku, and the services our customers demand, such as live TV and mobile phone service.” Customers for that Ku-band service include United Airlines, which became the first U.S.-based international carrier earlier this year to offer its customers the ability to stay connected while traveling on long-haul overseas routes.

Panasonic Avionics, which worked with EMS (now part of Honeywell) and Starling Advanced Communication on antennas, “is now manufacturing its antenna in (its) own factory and has taken over design responsibility,” said Hill. This move, which came shortly after the company’s parent, Panasonic Corp., acquired Starling, “has enabled Panasonic to really work at improving quality and reducing cost,” Hill said. “In the near future, we will be introducing a single panel antenna for the narrow body market and a tail mount antenna for the business jet market.”

Row 44 is tapping Hughes Satellite System to provide Ku-band connectivity service for service on more than 350 aircraft on seven U.S. and international carriers including Norwegian Air Shuttle and Southwest Airlines. The company is slated to equip the latter airline’s entire Boeing 737 fleet. Row 44 is using Tecom’s Kustream 1000 antenna system, which by early this year had already notched more than 1.5 million hours of use in commercial service, said Chandra. “We believe we are the leader in terms of flight hours on the commercial side,” he said.

JetBlue will be the first carrier to use ViaSat’s Ka-band Exede Internet for commercial airlines. “Testing of the system is ongoing, with STC flight tests coming soon,” said Diamond. The company has been contracted to install its in-flight system, working together with partner LiveTV, onto 370 JetBlue aircraft operated, and those installations are expected to begin later this year be completed by the end of 2015.

Flight Deck Connectivity

While the cabin has clearly taken the lead in the push for broadband, the flight deck is also upping its use of streaming data from electronic flight bags (EFB), for a variety of tasks including monitor engine performance or the maintenance cycle.

OEMs and operators are increasingly, however, “looking at the need for differentiating passenger connectivity from … the connectivity (needed) for air traffic control (ATC) and aircraft operation, such as enhanced weather information, online engine telemetry and the general provision of in-flight connectivity for the emerging population of (EFBs),” said Thygesen. This trend is driven by issues, “such as data integrity and separation, which is dealt with specifically … in ARINC 781 Chapter 8” — a standards process in “which Cobham has taken an active part.”

|

Esterline CMC’s CMA-2200SB Multi-channel

Intermediate gain antenna supports Classic

Safety Services, SwiftBroadband and future

SwiftBroadband Safety Services. |

On the flight deck, “if you are communicating with air traffic control, especially (via a) Controller Pilot Data Link Communication (CPDLC) or PM-CPDLC, that communication has to happen over a safety services certified pipe,” said Kurt Weidemeyer, Honeywell directorof marketing and product management. There are two companies offering these services today: Inmarsat and recently Iridium received some partial coverage acceptance by FAA over North Atlantic and Pacific.

When separating cabin and cockpit, CMC sees operators and manufacturers using “the higher bandwidth services carried on large Ku or Ka-band antennas … for the cabin and smaller, right sized, antennas for the cockpit,” said Maritan. “The key drivers are lower cost and smaller size.” One such “right sized” candidate is CMC’s CMA-2200SB Multi-channel Intermediate gain antenna, which weighs 6.5 pounds and supports Classic Safety Services, SwiftBroadband and future SwiftBroadband Safety Services, the company said.

Moving forward, however, there is an increasing need for a high speed connection for the iPads pilots are bringing on board, Kurt Weidemeyer, Honeywell director of marketing and product management. There is a growing demand to get, for example, real-time weather information using a connected iPad rather than relying on ACARS “which is a slow data connection outside of the U.S. for weather information,” he said. “The airlines understand that there are absolute rules and regulations for anything that touches certified equipment that actually run the aircraft … (but) we are seeing a lot more use of faster connections to … (non-flight critical devices) like iPads and that (trend) is going to continue.”

Looking a few years down the line, a key development would be to provide “user terminal antennas that support higher capacity satellite operation and allow proliferation to a large variety of mobile platforms,” said Diamond. “Cost, size and the ability to mount the antenna unobtrusively will strongly affect the number of different mobile platforms that can be targeted,” he said. These developments, however, “will be driven by the future satellite capabilities, (and) higher frequency bands may enter the picture, but ViaSat is focused on Ka at this time.”

Hill said he sees “incremental improvements in antennas and modems.” However, “the next big step in antennas” — electrically steered phased array antennas — are (still) very expensive and have to stay close the tropics due to the limited ability to point close to the horizon.”

Next month: Real-Time Operating Systems

Avionics Magazine’s Product Focus is a monthly feature that examines some of the latest trends in different market segments of the avionics industry. It does not represent a comprehensive survey of all companies and products in these markets. Avionics Product Focus Editor Ed McKenna can be contacted at [email protected].

Market Moves

The following are announcements made by developers of airborne antenna systems.

â–¶ Gilat Satellite Networks’ subsidiary Wavestream in January was awarded a contract by Honeywell to supply Ka-band transceivers for integration into airborne antenna systems to provide in-flight connectivity to the Inmarsat Global Xpress (GX) network. Scaled production for the transceivers is expected to begin in 2014.

Honeywell and Inmarsat signed an agreement in 2012 to provide global in-flight connectivity services to aviation customers around the world. Honeywell is developing and distributing the on-board hardware to enable users to connect to the GX Ka-band network.

“The combination of field experience and innovative technology was a critical factor in our selection of Wavestream’s Ka-band transceivers for integration into our Global Xpress antenna system,” said Chris Webster, senior subcontracts manager at Honeywell Aerospace.

“Wavestream is an established vendor in the aviation market and is well positioned to support the rapidly growing in-flight market,” said Francis Auricchio, CEO of Wavestream.

â–¶ Aircell in October signed an agreement with NetJets to add in-flight Internet service to nearly 100 additional aircraft in its fleet.

In 2010, NetJets elected to offer in-flight Internet service aboard more than 250 aircraft. This announcement for 100 additional systems will expand NetJets’ connected fleet by about 40 percent.

â–¶ Row 44, of Westlake Village, Calif., in January said its in-flight entertainment and connectivity service, which includes high-speed Internet, shopping, destination services and real-time flight maps, has been installed on 400 Southwest Airlines aircraft.

“The 400th installation of broadband capabilities on our fleet is a particularly significant milestone for Southwest and our partner Row 44,” said Dave Ridley, Southwest Airlines’ senior vice president and chief marketing officer. “Southwest was the first U.S. carrier to test satellite-delivered broadband Internet access on multiple aircraft. We have found the strength of satellite service has allowed us to deliver very high bandwidth for Internet users and provide our in-flight entertainment via the addition of live television.”