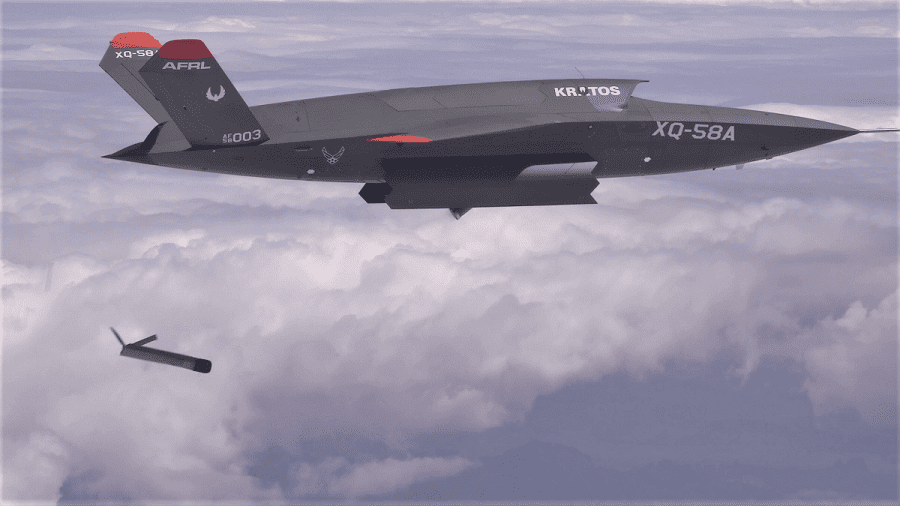

The Kratos XQ-58A Valkyrie releases the ALTIUS-600 small UAS in a test at the U.S. Army Yuma Proving Ground Ariz. test range in 2021, a test that marked the first time that the Valkyrie’s weapons bay doors have been opened in flight. (AFRL Photo)

Kratos Defense & Security Solutions recently unveiled a version of its Valkyrie stealthy, aerial combat drone with internal landing gear to enable conventional takeoff and landing to give customers more options, Eric DeMarco, the company’s president and CEO, said on May 7.

The jet-powered fixed-wing Valkyrie is currently launched off a rail using a rocket. The landing gear variant will fly this year, DeMarco said last evening on the company’s first quarter earnings call.

Development of the landing gear variant of the tactical unmanned aircraft system (UAS) was done in “conjunction and communication with several customers,” he said. The customers are not being disclosed.

The UAS can also be trolley-launched off a runway for training and to enable maximum payload capability, he said.

The goal with the Valkyrie family is to “provide runway flexibility and runway independence to our customers,” DeMarco said.

Kratos has begun serial production of 24 Valkyrie units using company funds and is flying with “multiple customers, expanding mission capabilities and other criteria as we progress toward” customer production decision, DeMarco said. Customers can visit the factory to “see their respective tail numbers in production,” he said.

DeMarco also disclosed that that the company’s Dark Fury hypersonic vehicle successfully flew its first mission at hypersonic speed, “achieving all expectations under a customer funded contract.”

Kratos has long-lead orders for “several” Dark Furies and Erinyes hypersonic test bed, which has also been successfully flight-tested, he said.

“Dark Fury is truly an incredible system, including its speed, range and precision characteristics and at its extremely low cost point, which is positioning Kratos, similar to Kratos jet drone family, to provide affordable mass and quantities,” DeMarco said.

There are also orders for about 70 solid rocket motors, including Zeus, for upcoming and expected hypersonic missions, he added.

The orders for the vehicles and rocket motors demonstrate the pending increase Kratos expects in hypersonic-related sales that will pick-up in the second half of 2025 and accelerate into 2026, DeMarco said.

Kratos’ “hypersonic franchise” will be the top growth driver in the next few years “unless global peace breaks out,” he said, adding that this goes beyond air vehicles and rocket motors to included the company’s position on spacecraft that detect and track hypersonic launches.

The second growth driver will be the company’s engine business, which includes turbojets, rocket motors, and space propulsion systems.

Third is microwave electronics, in particular the company’s business unit in Israel that sells internationally, he said.

If and when the tactical drone business takes off, DeMarco said this will be “one of the, if not the biggest needle mover for the company.” For now, the tactical drone outlook is a “call option” until the orders flow, he said.

Net income in the quarter more than tripled to $4.5 million, 3 cents earnings per share (EPS), from $1.3 million (2 cents EPS) a year ago. Excluding taxes, acquisition and restructuring costs, interest and other expenses, per share earnings of 12 cents beat consensus estimates by three cents.

Sales rose 9 percent to $302.6 million from $277.2 million a year ago, with 7 percent of the gain organic.

Growth drivers in the quarter were defense rocket systems, microwave products, C5ISR-related products, and target vehicles. Weighing on earnings was an operating loss in the Unmanned Systems segment due to increased material, subcontractor, and labor costs on multi-year fixed-price production contracts awarded in 2020 and 2021. DeMarco blamed higher subcontractor costs on a couple of companies that are increasing their prices.

The outlook for 2025 is unchanged, with organic sales still forecast to increase 10 percent, and then another 14 percent in 2026.

Orders in the quarter were robust at $365.6 million and backlog stood at $1.5 billion, up 4 percent from just over $1.4 billion at the end of 2024. Free cash flow was negative $51.8 million.

A version of this story originally appeared in affiliate publication Defense Daily.