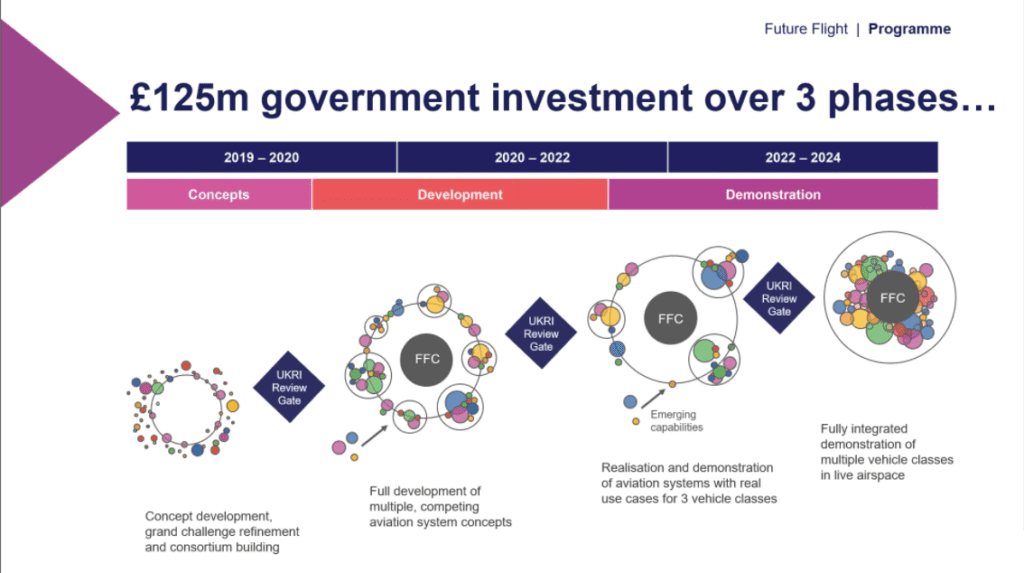

The UK’s Future Flight Challenge, promising £125 million toward electric and autonomous aviation projects, is one of many significant government pushes for competitiveness in future aviation technologies. Photo: UK Research and Innovation

Nations on both sides of the Atlantic Ocean have made significant regulatory and financial commitments to building sustainable aviation systems in the coming decades.

Some governments are more concerned with future domestic economic viability or military dominance than reducing carbon emissions, but the result has been robust investment across North America and Europe in aircraft electrification, hybrid powertrains, various hydrogen applications, sustainable biofuels and other related technologies.

Britain’s Future Flight Challenge, backed by £125 million from the state’s Industrial Strategy Challenge Fund, is broadly investing in aircraft and related technologies it views as part of a “third revolution of aviation,” according to Gary Cutts, Challenge Director at UK Research and Innovation.

“For us, we think that the third revolution is much more about freedom, on-demand services, and giving options to people … a much more thoughtful use of aviation,” Cutts said during a discussion hosted by AirTEC Munich, noting electrification and autonomy as some of the key technologies the British government hopes will improve mobility and address congestion.

Phase 2 of the challenge, which is open for proposals until July 1, will invest £30 million into projects across air traffic management, new aircraft, ground infrastructure and new operating models, emphasizing partners that aim to match new technology with new use cases. Applicable vehicles include regional and sub-regional jets, urban air mobility aircraft and large industrial-use drones.

“Having the use case and public interest front and center is really important for us,” Cutts said. “We don’t want to do a technology push and then somewhere downstream try to persuade people that they should like these aircraft. You need to do it much more exhaustively than that. You have to find use cases that the public want, that they’re fascinated by.”

For the United States, domestic economic interest is the driving force, alongside assuring future military dominance and supply chain security. The U.S. Air Force’s Agility Prime program, with $35 million in funds for fiscal years 2020 and 2021, is focused on reducing investment risk and assisting regulators in granting type certification, specifically for electric vertical takeoff and landing aircraft.

“If the hypothesis of the future of vertical flight is true, we want to make sure we’re growing that market domestically,” said Col. Nathan Diller, Agility Prime team lead and director of AFWERX.

Agility Prime intends to begin test flights “in the next several months,” Col. Diller said. Joby Aviation and Beta Technologies were recently announced as leading vehicle participants in the program.

Joby is also the only currently-ready vehicle provider for NASA’s Advanced Air Mobility (AAM) National Campaign, previously known as the Urban Air Mobility Grand Challenge. The first developmental test flights will occur this spring, according to program manager Starr Ginn.

That program, funded at about $20 million annually and slated to run until at least 2028, intends to collect data across a variety of areas — vehicle performance, airspace integration, infrastructure requirements — to help the Federal Aviation Administration form requirements across many areas, including reserve requirements and how to interface with air traffic control during various contingency scenarios.

Current schedule for NASA’s Advanced Air Mobility National Campaign. (NASA/Starr Ginn)

NASA recently released renewed its call for vehicle information exchange partners, seeking companies close to flying their prototypes that could work with the AAM campaign once they have completed envelope expansion.

The Bavaria region of Germany, home to a number of major OEMs as well as prominent aviation startups (including Lilium and Volocopter), is also investing heavily in its future competitiveness. The government intends to invest a “3-digit million amount of Euros” in its high-tech agenda, according to Peter Schwartz, managing director of bavAIRia. That agenda includes aerospace, AI, robotics and hydrogen technologies.

All levels of the Canadian government are supporting clean mobility as part of a broader industrial push to develop clean technologies, reduce emissions and “future-proof” the economy. Through the Clean Growth Hub, a group of 16 different government agencies and funding streams, Canada is investing more than $1.6 billion per year in clean technologies.

In British Columbia, additional regulatory levers are being used to aggressively encourage sustainable mobility. By 2040, every new car sold in the province will be a zero-emissions vehicle. In February, the province also passed a tax exemption for all electric aircraft and related services, but there isn’t yet a mandate regarding aviation emissions. J.R. Hammond, founder and CEO of Canadian Air Mobility, is advocating to require all flights less than 1.5 hours to be emission-free in twenty years.

“[Climate change] is not an ‘I’ problem. It is not a ‘you’ problem. It is a ‘we’ problem. With that mentality, it really opens up some solid ground for creating collaborations beyond the conventional borders we know as countries at the moment,” said J.R. Hammond, founder and CEO of Canadian Air Mobility, which is advocating to include clean aviation technologies as part of the future of the Cascadia Corridor that connects the northwest United States with Vancouver.

There is significant cross-border cooperation between many of these projects. NASA’s renewed call for vehicle information exchange partners allows foreign companies to participate; Ginn stressed the importance of coordination between FAA and the European Union Aviation Safety Agency (EASA) to create common future standards and avoid a partitioned future global market.

But competition exists as well. Germany, Britain, Canada and the United States — all nations with sizable aerospace sectors — want to ensure they are competitive in the future aviation ecosystem, to include electric, hybrid and hydrogen systems.

The ‘tipping point’ for investment in truly sustainable aviation may now be behind us.