Global Avionics Round-Up from Aircraft Value News (AVN)

The U.S. Federal Aviation Administration’s (FAA) ambitious NextGen air traffic modernization program was designed to revolutionize U.S. airspace with satellite-based navigation, real-time data sharing, and streamlined traffic flows.

However, over a decade after its launch, the full promise of NextGen remains frustratingly incomplete. Critical gaps persist in the implementation of its most advanced, avionics-based features, particularly those designed to optimize traffic flow through more precise aircraft tracking and management.

This lag in technological uniformity has significant consequences not only for air traffic efficiency but also for the valuation of commercial aircraft, especially in the secondary leasing and resale markets. As regulators, operators, and OEMs struggle to align on rollout and standards, aircraft that lack the latest avionics upgrades risk falling behind, not just in performance but in financial worth.

Vision vs. Reality

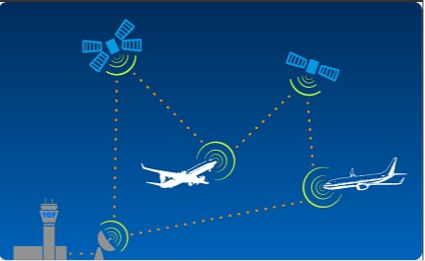

NextGen’s central premise is deceptively simple: replace the radar-based system of the mid-20th century with a digital network using GPS, satellite surveillance, and data link communications. This would enable aircraft to fly more direct routes, reduce holding patterns, and allow for more precise separation in crowded airspace. In theory, this leads to lower fuel burn, fewer delays, and a reduced carbon footprint.

One of the system’s most critical innovations is avionics-based traffic flow infrastructure, particularly the widespread adoption of Automatic Dependent Surveillance–Broadcast (ADS-B) Out and In, DataComm, and Performance-Based Navigation (PBN). However, this infrastructure is not yet consistently in place across aircraft fleets, airports, or even Air Traffic Control (ATC) facilities.

While ADS-B Out has been mandated since January 1, 2020, many aircraft are still not equipped with ADS-B In, which enables the reception of traffic and weather data in the cockpit. Likewise, DataComm, which is meant to replace voice communication with ATC via text messages, is active in some terminal areas but lacks nationwide coverage. And while PBN procedures exist, their full integration depends heavily on aircraft avionics and pilot/operator training, which remain uneven.

Value at Risk

For aircraft owners, lessors, and appraisers, the incomplete implementation of NextGen has become a hidden but mounting concern. Aircraft values increasingly hinge not just on age, airframe hours, and maintenance records, but on connectivity and compliance with digital airspace systems.

A jet equipped with full NextGen avionics can access preferred airspace, experience shorter flight times, and reduce fuel costs, making it more attractive to operators.

By contrast, aircraft without full NextGen functionality may face route restrictions, higher operational costs, and limited airport access, especially in congested areas like the Northeast Corridor or Southern California. These limitations translate into real economic penalties. For instance, lessors may find their aircraft sidelined in competitive lease bids due to obsolescence in cockpit systems.

Even newer aircraft may be affected if buyers defer optional avionics packages to cut costs, only to later discover that the upgrade pathway is costly and time-consuming. As a result, a bifurcation is emerging in the marketplace between “NextGen-ready” assets and those that are technologically lagging, with appraisers beginning to factor this distinction more heavily into residual value forecasts.

Infrastructure Drag

A key reason for the sluggish rollout of avionics-based traffic flow tools lies not with the aircraft themselves, but with the ground infrastructure and institutional inertia. The FAA’s own Inspector General has flagged “implementation gaps” in controller training, software integration, and inconsistent deployment of NextGen capabilities at control centers.

Without harmonized infrastructure, the benefits of upgraded avionics remain theoretical. Aircraft equipped with ADS-B In and DataComm may still have to operate under legacy protocols if the destination airport or en-route ATC facility lacks the corresponding tech. This creates a “lowest common denominator” effect, discouraging carriers from investing in optional upgrades that won’t see immediate returns.

Moreover, the international picture is even more fragmented. European efforts under the Single European Sky ATM Research 3 Joint Undertaking (SESAR) are making strides, but interoperability challenges persist. For aircraft that operate transatlantic routes, inconsistent standards between the FAA and Eurocontrol further cloud the ROI on NextGen-equipped airframes.

Winners and Losers

Certain types of aircraft are poised to benefit from closing the NextGen implementation gap, particularly newer narrowbodies like the Airbus A320neo and Boeing 737 MAX families, which often come factory-equipped with advanced avionics suites. These aircraft can command higher lease rates, especially among airlines looking to streamline operations in congested airspace.

Regional jets and older widebodies, on the other hand, are more vulnerable. Retrofitting them with the necessary hardware and software to meet NextGen standards can be prohibitively expensive, leading some operators to retire otherwise serviceable aircraft. The result: a compression of value for technologically outdated jets, with ripple effects across leasing portfolios.

This article also appeared in our partner publication, Aircraft Value News.

John Persinos is the editor-in-chief of Aircraft Value News.