Global Avionics Round-Up from Aircraft Value News (AVN)

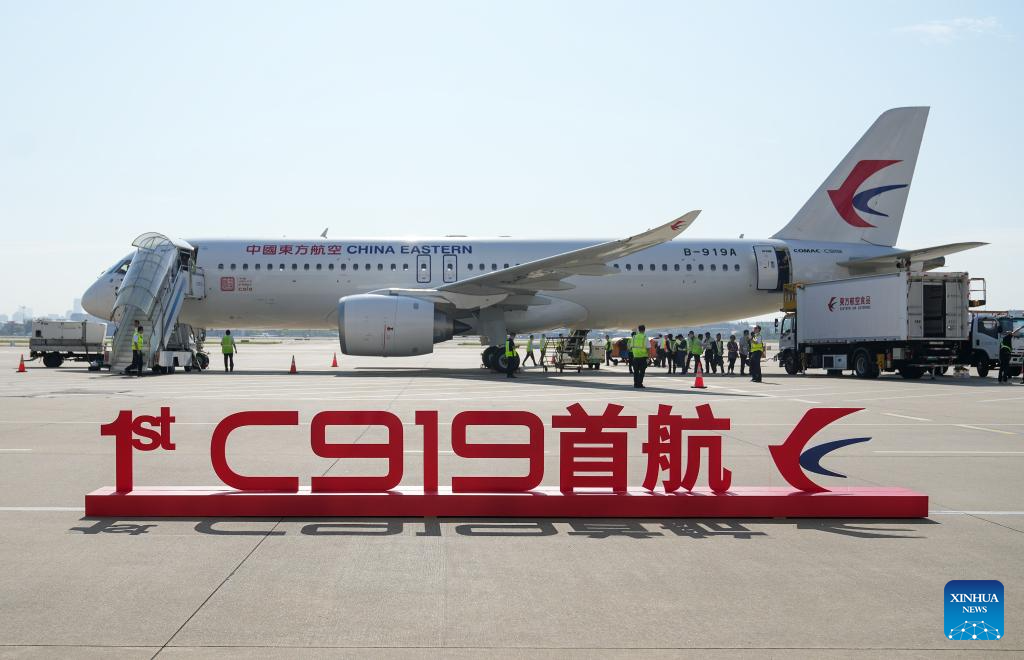

China’s C919 made its official entry into the civil aviation market.

For decades, Western aerospace giants like Honeywell, Thales, and Collins Aerospace have dominated the avionics market, supplying critical systems for both commercial and military aircraft around the globe.

However, China is emerging as a formidable challenger. Armed with a state-driven mandate for technological independence, the Chinese aviation industry is rapidly developing indigenous avionics technologies that not only rival their Western counterparts but also threaten to erode their global market dominance.

At the heart of this shift is the Aviation Industry Corporation of China (AVIC), a sprawling state-owned conglomerate that has poured billions into advancing avionics systems for platforms like COMAC’s C919 and the forthcoming CR929.

One of AVIC’s most consequential achievements is the development of a domestic Integrated Modular Avionics (IMA) platform. This system architecture, which consolidates multiple avionics functions into shared processing modules, mirrors the sophisticated layouts used on Airbus A350s and Boeing 787s. It marks a major departure from China’s previous reliance on imported IMA systems from Western suppliers.

The shift enables not just faster avionics development but also software flexibility, better fault isolation, and reduced maintenance costs, all designed and manufactured without U.S. export restrictions.

Homegrown Technology, in the Skies and in Space

Equally transformative is China’s use of its own satellite navigation system, BeiDou. Integrated into both military and civilian aircraft, BeiDou offers a complete alternative to the American GPS, Russian GLONASS, and European Galileo systems. For countries under threat of Western sanctions or export restrictions, the idea of a truly independent, satellite-guided flight management ecosystem is alluring—and China is positioning itself to provide it.

Another area where China is making strides is in Fly-by-Wire (FBW) systems. Historically, the control laws and redundancy frameworks for FBW in commercial aircraft were the domain of Western software engineers.

Today, the C919 boasts a homegrown FBW system with indigenous control laws—core to managing flight stability, pitch and roll behavior, and emergency response. The fact that China has developed, tested, and implemented these laws without reliance on external expertise speaks volumes about its maturity in flight software.

While these advancements are impressive, the most forward-looking innovations are coming from China’s push to integrate artificial intelligence (AI) into avionics.

AVIC has been testing AI-driven health monitoring systems that proactively diagnose and predict component failures in engines and other critical systems. These predictive maintenance tools are designed to reduce operating costs, minimize downtime, and improve overall aircraft safety. Similar to GE’s Predix or Honeywell’s GoDirect, China’s version may soon appeal to developing nations seeking high-tech features at lower price points.

One of the more subtle yet powerful changes taking place is the move toward open-architecture avionics, a strategy that unifies military and civilian applications. In contrast to the tightly controlled, proprietary systems favored by many Western firms, open architecture allows for faster system upgrades, sensor integration, and broader cross-platform compatibility.

This modularity is being applied across the board, from the J-20 stealth fighter to the upcoming CR929 widebody jet, and it gives Chinese engineers the ability to plug in new capabilities, such as radar, jamming, and satellite communications, without having to overhaul entire systems.

Meanwhile, China has also developed its own Flight Management System (FMS), long considered one of the most complex elements of avionics design. FMS governs everything from navigation to fuel efficiency and compliance with air traffic management rules.

Replacing Western FMS solutions with a domestically produced alternative not only cements China’s self-sufficiency but also lays the groundwork for a more exportable product that doesn’t carry U.S. International Traffic in Arms Regulations (ITAR) baggage.

While Chinese avionics systems are not yet equal in every respect to their Western counterparts, the trajectory is unmistakable. China is no longer playing catch-up; it’s beginning to innovate on its own terms.

This article originally appeared in our partner publication, Aircraft Value News.

John Persinos is the editor-in-chief of Aircraft Value News.