|

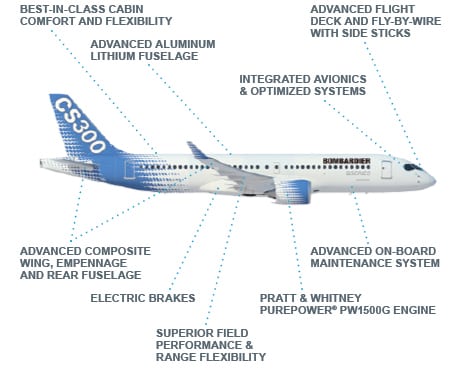

| Diagram of Bombardier’s C Series aircraft. Photo: Bombardier |

[Avionics Today 11-12-2015] Just when it looked like Bombardier’s C Series program may be winding down to a close, it seems to be revving up in the way of funding and momentum that may help to push the aircraft through its last leg of flight testing and into the market. The Canadian company’s all-but-cancelled aircraft program, which stands to challenge the Airbus A320 and Boeing 737 in the marketplace, is seeing new life with announcements that the Quebec government will provide $1 billion in funding, the possibility of more government backing, and an understanding that the program is nearing completion.

“With our flight test program almost 100 percent complete and all the high-risk CS100 aircraft’s flight tests behind us, teams are now finalizing the last few certification activities,” Rob Dewar, vice president of the C Series aircraft program at Bombardier Commercial Aircraft, said in a statement regarding the progress of the program on Nov. 9. “Following more than 1,000 flights conducted by the C Series flight test vehicles, the [Function and Reliability] F&R flights will give a really good indication of how the C Series aircraft will perform in a typical airline schedule to and from different airports in Canada and the U.S.”

Meanwhile, Latvia-based airBaltic has come out as the first customer to operate the CS300 aircraft when it takes delivery in the second half of 2016. The Latvian flag carrier has 13 CS300 aircraft on firm order and retains options for seven CS300 aircraft.

The recent progress comes in the light of funding, sales, and technical issues that have pushed the long-overdue program back three years from its scheduled entry into market. In the past year in particular, Bombardier has seen rough seas, cutting — or

“pausing” — the Learjet 85 program to funnel resources into the C Series flight tests and shaking up management to streamline the program. Early last month the company admitted to approaching Airbus, which has been trying to sink the C Series program it sees as competition in the single aisle, 100- to 149-seat commercial aircraft market, in the attempt to sell a stake to the airframer in return for the funding to bring the aircraft to market.

The Quebec government stepped in to help the struggling program, however, promising $1 billion in funding in return for a 49.5 percent stake in the company. Bombardier announced the limited partnership with Quebec during its third quarter 2015 conference call late last month, at which the company noted it was nearly $9 billion in debt, including a $3.2 billion charge related to schedule delays for the C Series. Despite losses, the Quebec government and industry groups see value in the program in the way of employment and economic opportunities for the region.

“Bombardier is the flagship company for the aerospace industry in Quebec and Canada. Supporting it is necessary to maintain quality jobs in Quebec. The government’s investment comes at a strategic time in the development of the C Series program and will reassure all stakeholders in Quebec’s aerospace supply chain. Among others, maintaining manufacturing activities and Bombardier’s engineering services in Quebec will help spark renewed optimism among the industry, as well as among all the workers and students who are developing or want to develop in this sector,” Suzanne Benoit, president and CEO of Aero Montreal, a think tank that groups all the major decision makers in Quebec’s aerospace sector, including companies, educational and research institutions, as well as associations and unions, said in a statement following the announcement.

With this attitude, it’s possible that Bombardier can see more government funding on the horizon, but the company will have to make a “strong business case,” if it wants to see more federal capital come its way, Canadian Prime Minister Justin Trudeau told a meeting of labor leaders on Nov. 10.

“There’s no question that high-value manufacturing is going to be an extremely important part of Canada for years to come. Aerospace is a great example of that, as is the auto sector and others,” Trudeau said in a closed-door meeting of the Canadian Labor Congress (CLC) yesterday, according to a partial transcript released by his office. “We are going to make sure that decision is taken based on what is in the best interest of Canadians, writ large.”

Even with more funding, it would take quite a bit more capital than most realize to save the program, Richard Aboulafia, vice president of analysis at the Teal Group, told Avionics Magazine.

“Yes, [the government] will back them somewhat. Last week’s announcement from the Quebec government, which was backing to some extent, was a good indication. But is it the support — is it the amount of cash needed to get the job done? Hell no,” Aboulafia said, questioning as to whether the governments involved understand the amount of funding it may take to support the program. “This is not the cost of bringing the aircraft to market, the costs peak when you start building the aircraft and ramping up production.”

While Quebec believes the government support is merited in the way of jobs and resources it will provide to the region, Aboulafia sees this kind of backing as pulling the aircraft program in a direction other than its original intent.

“If you start spending billions of dollars on a large commercial jetliner program on top of the billions that have already been spent, then you have a socialist-era jobs program rather than a real commercial enterprise,” said Aboulafia.

Despite doubts about the program’s future and setbacks in sales, however, the analyst continues to back the jet behind the program, which promises operators potential savings of between $7.5 to 12 million per aircraft on fuel and operational savings, alongside lowered carbon emissions.

“It’s a good jet, by all means it deserves to survive on the basis of its technological and economic merits. But it’s not selling, and that suggests a lot about what the market wants and the company’s ability to be commercially aggressive,” Aboulafia added.

Bombardier has made clear its intentions to carry the aircraft to market, despite the setbacks in sales and analyst skepticism that the program has the support necessary to bring the aircraft to term.

“Let me be clear; we are committed to the success of the C Series. The C Series aircraft is the benchmark in the 100 to 150 seat class segment and it is exceeding performance targets,” said Bombardier President and CEO Alain Bellemare during the company’s third quarter earnings call earlier this month. “We have a great product, a great program, and there is lots of momentum building up … with the investment with Quebec, we believe now we have the right valuation as well as the ability to generate strong returns on those investments going forward.”