|

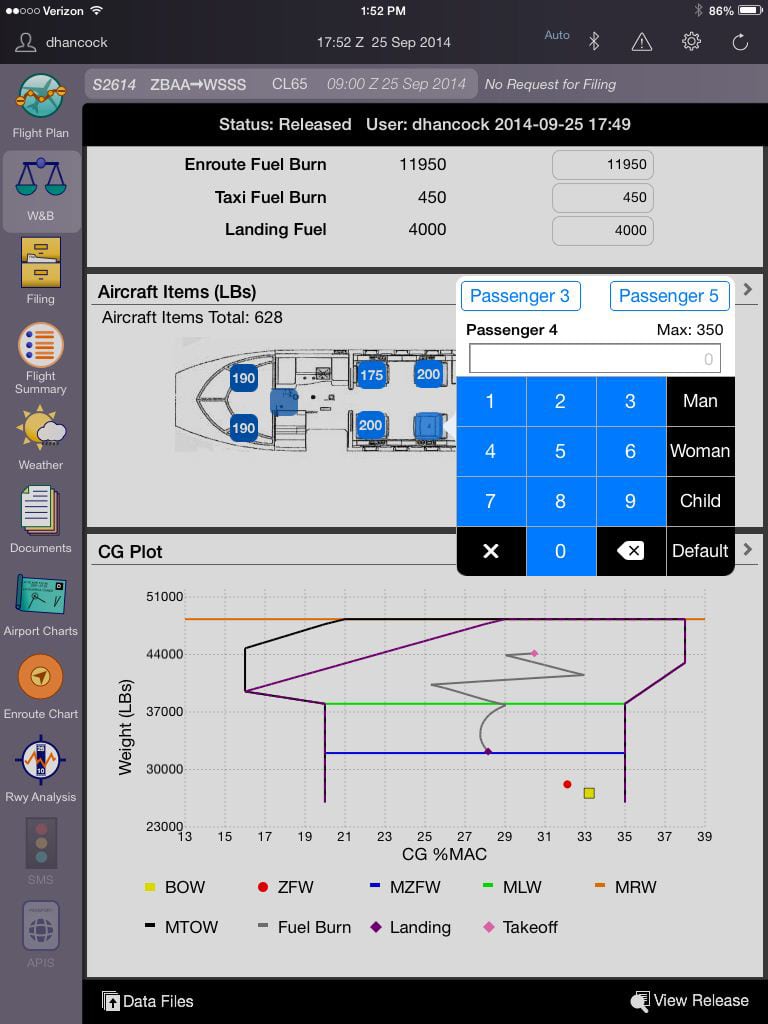

| Rockwell Collins connectivity division ARINCDirect’s iPad app. Photo: Rockwell Collins |

[Avionics Today 11-03-2014] In the fourth quarter Rockwell Collins earnings conference call on Friday, President and CEO Kelly Ortberg touted a successful fiscal year for the company. Full fiscal year sales totaled $4.93 billion, an 11 percent increase over 2013, due mostly to growth in four key markets: commercial Original Equipment Manufacturers (OEM), air transport, the newly added Information Management Services (IMS) sector, and a reshaped government portfolio.

“Overall I give us high marks for what we did to achieve our top-line growth in 2014. And just as important is the fact that good work is going to continue to drive additional revenue for years to come,” Ortberg said.

One of these areas of growth is the newly added IMS segment of the company, which aims to provide secure aircraft communications, leveraging the growing In-Flight Connectivity (IFC) market. The company’s new IMS segment has been branded ARINC Direct, resulting from its 2013 acquisition of airborne communications provider ARINC. ARINC Direct is a combination of Rockwell Collins’ former Ascend Flight Information Solutions and ARINC services for flight planning, international trip support, cabin connectivity and flight operations management. Ortberg reports that the outcome of the acquisition is “exceeding expectations,” but the company is still looking to expand its IFC portfolio in coming years.

“We have not been a strong cabin connectivity provider and that’s a space we’re looking at,” said Ortberg. “We’ve teamed with Inmarsat to be a value-added reseller of their next generation connectivity solution, but that’s for what I’ll call open-world cabin connectivity.”

Outside of Rockwell Collin’s partnership with Inmarsat, the company is looking to strategize before it continues to expand its IFC offerings in order to mitigate competition.

“I will grant you there are a lot of people in that space right now,” Ortberg said, referring to the connected aircraft market. “How we play and how successful we are is something we’re continuing to work on going forward.”

While the IMS segment promises to be fruitful, the company’s reworked government portfolio can promise a flat line at best, at least for fiscal year 2015. But a flat line is better than the losses the segment has taken in the last few years, and the pick-up in business can be much attributed to the avionics segment.

“If you look at our total avionics portfolio we’re expecting that to be our strongest portfolio next year, fiscal ’15, out of our government portfolio,” Ortberg said. He points to programs such as the KC-10, KC-135 and some international C-130s as driving demand for avionics. Rockwell Collins also has positions on the F-35, “so as the F-35 ramps up production we’ll see some growth there,” he said.

The U.S. Navy’s Future Airborne Capability Environment (FACE) project also offers some opportunity for growth in the government avionics market as they look to modify systems in a way that allows for easier, more efficient software updates that are not proprietary to the OEM.

“The Navy has been moving to an open systems architecture definition that they define as the acronym FACE and they’re looking for next generation avionics that are FACE compliant,” Ortberg said. “That’s a space we play in and that we’ve always played in … That’s one of the ways we differentiated ourselves in the market, by bringing commercially derived open systems technology. So I don’t see that as a competitive threat, I see that as an opportunity going forward.”

One market that Ortberg doesn’t see as a potential opportunity in the near future, however, is the Unmanned Aircraft Systems (UAS) market, mainly due to the political climate.

“We’ve pulled out of Iraq and Afghanistan and the production rates of unmanned platforms has declined,” Ortberg said. “While the idea and the concept is robust and I think there will be a future for it, the near term market is just not that strong.”

When the market does pick up, however, Rockwell Collins is well equipped to provide communications, navigation and flight control systems for UAS due to its 2008 acquisition of Athena Technologies, a company that develops and provides flight control and navigation solutions primarily for UAS. Ortberg also said that Rockwell Collins is currently working with the FAA and NASA to define the next generation of control links to UAS platforms in order to allow the systems to operate in the National Air Space (NAS).

“I think there’s going to be opportunities in both the commercial and government space, but the thing we’ve got to really work on is the ability for them to safely operate in civil airspace, which means civil certification of control links that are high availability and reliability, and that’s a good space for us,” he said.

There are no guarantees but, with a strong 2014, Ortberg is optimistic for next year’s revenues.

“2014 was a really good year, and I like how we finished the fourth quarter. It tells me our strategies are working and I believe we are positioned to carry this momentum into 2015,” Ortberg concluded.